In 2025 and early 2026, buyers across multiple industries — especially automotive, industrial equipment, and electronics manufacturing — have increasingly focused on Nexperia alternative sources. This trend stems from deepening supply chain disruptions and heightened geopolitical risk that have made reliance on Nexperia’s semiconductor products less secure than before. What was once a dependable supply of discrete chips and logic semiconductors has been thrown into uncertainty, forcing buyers to reassess their sourcing strategies and proactively explore alternatives.

The Current Supply Chain Disruption

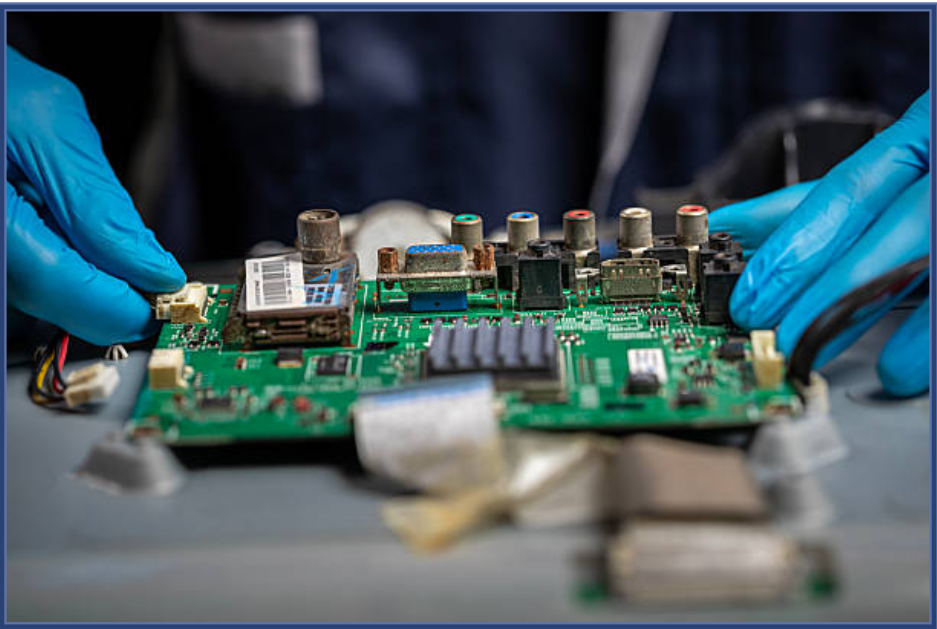

Nexperia is a significant supplier of automotive‑grade diodes, transistors, and other widely used semiconductors. These products appear in vehicle control systems, power modules, and countless electronic assemblies across many industries. However, in late 2025, a complex dispute involving the company’s Chinese operations led to substantial disruptions in global shipping and deliveries. Chinese export restrictions and Dutch government intervention resulted in wafer supply halts and export bans for certain Nexperia components.

The combination of export bans and legal uncertainty at the company has slowed or halted production of many parts, particularly those manufactured and assembled in its Dongguan, China facility. This has directly affected customers who depend on these components for production — especially automakers who have limited inventory buffers and just‑in‑time manufacturing models.

Even though Nexperia’s Chinese unit resumed some sales domestically later in 2025, regulatory and quality certification concerns remain. Parts processed in China since mid‑October 2025 may lack verified quality guarantees, further heightening buyer anxiety and reducing confidence in relying on those supply channels.

Immediate Effects on Buyers

Manufacturers dependent on Nexperia parts have reported substantial impacts — from production slowdowns to halted assembly lines. Major automotive OEMs and tier‑1 suppliers, including those serving companies like BMW, Mercedes, Toyota, and VW, have warned that shortages could halt or delay vehicle production. Marquee companies have even reduced volumes at certain plants due to lack of components.

Because many Nexperia components are legacy parts, designed not for cutting‑edge performance but for reliability and longevity, they are deeply embedded in vehicle systems and other devices. Replacing them requires not only finding an equivalent electronic part but also rehomologating that part — a process that can take months and involve complex validation testing.

As a result, buyers are not simply looking for substitutes but are urgently seeking Nexperia alternative sources that offer both availability and compatibility. Securing alternatives isn’t easy, as such components often need to meet automotive safety standards like AEC‑Q101, demanding high reliability and performance under demanding conditions.

Why Buyers Are Actively Seeking Alternatives

1. Supply Continuity Is Under Threat

Manufacturers cannot afford the risk of being dependent on a single supplier, especially one subject to export restrictions and international disputes. The fact that export bans and regulatory actions could stop shipments with limited notice has made risk management and supply diversification a priority. Buyers want Nexperia alternative sources that are less exposed to political and trade volatility so that production schedules remain stable.

2. Quality and Reliability Concerns Drive Diversification

When parts are not guaranteed to meet quality or authenticity standards — as has been the case with certain batches processed in China — buyers hesitate to accept deliveries, fearing product failures or liability issues. This has motivated buyers to look for alternatives that deliver traceable quality and meet international standards.

3. Inventory and Lead Time Pressures

With existing stocks of Nexperia components expected to run out within weeks in some supply chains, buyers are scrambling to ensure continuity. Automotive industry planners, for instance, have noted that homologating and qualifying new suppliers often requires several months, a timeline they cannot afford without drastically slowing production. This urgency underscores the push toward Nexperia alternative sources with stronger availability.

4. Market Price Impacts

Component shortages typically lead to higher costs. As lead times extend and stock depletes, buyers are not only seeing longer wait times but also rising prices. This economic pressure is a powerful incentive to decentralize sources and identify alternatives that might offer more stable pricing and shorter lead times.

Typical Alternatives Being Considered

Buyers are exploring several alternative semiconductor suppliers that produce functionally similar chips. Large players like Infineon, On Semiconductor, Renesas, ROHM, and STMicroelectronics are often cited as viable sources of automotive‑qualified discrete and logic devices. While these alternatives may have different specifications, with thoughtful engineering and testing they can often satisfy system requirements where Nexperia parts were used.

Yet alternative sourcing also has its hurdles. Even when a functionally similar component exists, validating it for safety and performance in a complex system requires engineering time, test labs, and regulatory compliance work — all of which cost time and money. This is why many buyers were caught off guard by the supply disruption, prompting urgent realignment of procurement strategies.

Long‑Term Implications

In the longer term, the Nexperia supply crisis has become a wake‑up call for supply chain managers. It highlights the importance of diversification and resilience planning, not only at the sourcing level but across internal procurement and engineering planning functions. Companies are now more inclined to develop risk assessment frameworks that consider geopolitical risk, inventory buffers, and multi‑sourcing strategies for critical components.

Ultimately, the push for Nexperia alternative sources reflects broader shifts in global supply chain thinking — a move away from dependence on a single supplier or region toward a more resilient, diversified procurement model that can absorb shocks and maintain production continuity even in turbulent conditions.